|

|

Estate Administration

Friday, July 19, 2013

Every Will names one, or sometimes two, people as Executor. This person is then responsible for taking charge of the deceased person’s assets, paying debts, and distributing the property to the beneficiaries to close down the decedent’s estate. While the executor is oftentimes a beneficiary of the Will, he or she must treat all beneficiaries fairly and in accordance with the provisions of the Will.

So what exactly do you have to do if you’ve been named executor? First, you must obtain the original, signed Will and other important documents, such as certified copies of the Death Certificate. Then the executor must notify everyone who has an interest in the estate or has been named as a beneficiary in the Will. This includes anyone who has been disinherited from the will.

The executor must take steps to secure all assets and get their value at the date of death. Assets of an estate include all real and personal property owned by the decedent. Commonly overlooked assets include stocks, bonds, pension funds, safety deposit boxes, and work-related life insurance or survivor benefits. The executor must also compile a list of the decedent’s debts, including credit cards, loan payments, and mortgages. All of the decedent’s creditors must be notified and given the opportunity to make a claim against the estate.

Once values are obtained, the executor must file all tax returns, including federal and state income tax returns. Additional tasks can include notifying carriers for homeowner’s and auto insurance policies and initiating claims on life insurance.

Fortunately, as executor you are entitled to find an estate administration attorney to help guide you through this process. The attorney knows everything that needs to be accounted for, and how some of the more complicated processes of closing an estate, like probate, works. This attorney will then be paid for by the estate and not out of your own pocket. Also, serving as executor entitles you to compensation for your services.

If you have been named as the executor of a Will and need help administering the estate, call our office at (717) 560-4966. We would be happy to assist you any way we can.

Thursday, January 3, 2013

As a part of Congress's tax compromise to avoid falling down the fiscal cliff, the exemption amount for estate taxes will remain the same as it has been for the past two years. The American Taxpayer Relief Act, passed in the House by a vote of 257 to 167, permanently sets the estate tax exemption at $5 million for an individual (adjusted to $5.12 million due to inflation) and $10 million for a couple (adjusted to $10.24 million). With new inflation amounts, the exemption is expected to rise to about $5.2 million.

The gift tax and generation-skipping transfer tax exemptions will remain the same as last year as well. They will be adjusted for inflation as the estate tax exemption was.

Congress, however, did make one change to the prior rules, by increasing the maximum tax rate by 5 percentage points. This raises it to 40 percent. Tax rates of 37, 39 and 40 percent will apply, depending on the value of the estate.

This bill and it's provisions would take effect January 1, 2013. However, until President Obama signs it, the estate tax has technically reverted to its 2011 level of 55 percent and the estate tax exemption level has dropped to $1 million. Still, President Obama has promised to sign the bill, and should be doing so quickly.

Monday, December 31, 2012

In the news, there has been a lot of talk about the impending "fiscal cliff," and if Congress and the  administration can't strike a deal, starting tomorrow, January 1, there will be spending cuts and tax increases because of this cliff. These changes have the potential to greatly impact many families, especially in terms of estate planning. administration can't strike a deal, starting tomorrow, January 1, there will be spending cuts and tax increases because of this cliff. These changes have the potential to greatly impact many families, especially in terms of estate planning.

In the new year, the federal estate tax and gift tax exemptions will drop from their current level of $5.12 million to $1 million. This means that if your estate values over $1 million, only the first million dollars will be exempt from tax, leaving the rest subject to tax rates that will also be increasing. In 2012, the maximum tax rate was 35 percent; under current law it will be raised to 55%. Tax rates have not been that high since 2001, and the exemption level was last at $1 million in 2003.

These two changes will all of a sudden cause quite a few people to worry about estate planning who weren't worried before. Families with estates under $1 million can still relax, and those with estates valuing over $5.12 have likely already structured their wills to protect from estate taxes. However, estates totaling between $1 million and $5.12 million are probably not ready for these changes.

There are several different techniques available to get out of the direct line of fire of the new estate tax laws. Establishing trusts and using different insurance methods are two, but there are many others available. The best plan of action would be to seek counsel from an estate planning attorney who knows all the available options and can establish the plan most suited for your needs. While it's not too late to take action, moving quickly will best protect your family and the legacy you leave behind in the new year.

Unfortunately, most action taken now will likely prove to be unnecessary in the future, but how soon in the future is unknown. Exemptions and tax rates have changed 9 times since the start of the century, and because most congressmen have estates larger than $1 million and will want to protect themselves from the high rates, it is likely that the exemption amount will raise to around $3 million. However, the specifics of these changes and how soon they will come into effect are unknown at this time, and with so much uncertainty surrounding them, it is best to take action and protect your family as soon as possible.

Monday, July 16, 2012

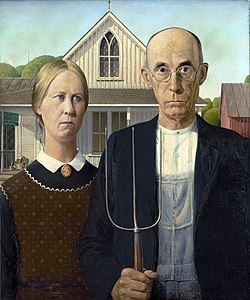

On July 2, Governor Tom Corbett signed a piece of legislation that exe mpts farmers from inheritance tax. This law, effective for all deaths after June 30, 2012, allows farmers to pass down their farms to their heirs without having to worry about the farm paying taxes after death. These taxes (4.5% for children of the decedent, and 12% for siblings) left a large burden for those inheriting them, because although farmers are rich in land, they are often time poor in cash. In order to pay the taxes, they would have to sell their farmland, causing farms to shrink in size and productivity as the family line grew longer. mpts farmers from inheritance tax. This law, effective for all deaths after June 30, 2012, allows farmers to pass down their farms to their heirs without having to worry about the farm paying taxes after death. These taxes (4.5% for children of the decedent, and 12% for siblings) left a large burden for those inheriting them, because although farmers are rich in land, they are often time poor in cash. In order to pay the taxes, they would have to sell their farmland, causing farms to shrink in size and productivity as the family line grew longer.

When signing the bill, Corbett said that this tax has forced many families "to sell their legacy, their land and their way of life." Now, as long as the farm is a working farm, it can be passed to immediate family members without having to pay inheritance tax. In the past, farmers all knew of friends that had to dissolve the farm to pay inheritance tax. Now, the nearly 63,000 farming families in Pennsylvania will be able to pass along the land and the business.

Cutting this tax is obviously cutting a source of revenue for state operation, making the budget a bit tighter. However, agriculture is the top industry in the state, so this law could be healthier for the future of Pennsylvania. The 8 million acres of farmland in Pennsylvania generates almost $6 billion in sales each year, and by protecting the land through eliminating inheritance tax, Pennsylvania can protect this industry.

Friday, July 6, 2012

Here are the 8 most common mistakes executors make when administering an estate. There are oftentimes other mistakes made as well, so you should seek legal advice to ensure that all matters are handled.

1. Probating the Wrong Documents. When most executors hear the word “probate” they think of the long, difficult, expensive process of administering an estate and want to avoid it. But, in Pennsylvania, that is mistake number one! Pennsylvania’s probate process is not nearly as bad as most states and is in fact fairly easy, simple, and straight forward. When someone ways they are going to probate a will, it means that you are going to the Register of Wills and someone there will verify that the will is authentic and that you are indeed the executor. Then, as executor, you will take an oath promising to protect and distribute the estates assets. There will be a small probate fee, but not nearly as large as other states.

One of the first duties an Executor must do is to make sure that you have the right documents. These are the most recent documents, so check the safe deposit box and with the lawyer who drafted the documents at the very least to make sure there aren’t more recent documents!

2. Distributing early without protection from liability for that distribution. As Executor, you are personally liable for the estate and distributions. When executors make distributions before everything else is done, the executor is personally at risk (and these distributions are known as “at risk distributions”). This does not mean that you cannot give some money out before paying creditors and anyone that can assert a claim or the estate assets, it just means that you better make sure that you can get the money back if there has been a miscalculation!

3. Failing to comply with probate requirements. In Pennsylvania, like we previously mentioned, the probate requirements aren’t too strict, however there are a few things that must be done. Once sworn in as Executor, Pennsylvania requires that everyone named in the will is at least notified that it is in probate. Once everyone is notified, you must notify the court by filing a certification. If you are using an attorney to help administer an estate, they will do it for you and make sure it is done correctly. Additionally, if someone has been disinherited under a will (for example a child), they must receive notice. People do have the right to challenge the will, so Pennsylvania law requires that everyone who is supposed to know about this does know about the will.

4. Failure to get discount for early inheritance tax payment. Pennsylvania gives a discount for paying the inheritance tax within 3 months, rather than waiting 9 months when the inheritance tax is due. But just because there is this discount doesn’t mean that you should rush to pay the inheritance tax. Sometimes, say if you’ve got a lot of cash, it makes sense to pay the inheritance early and receive the discount. In other situations, you may be earning more than the value of the discount with the money in another investment form. Getting the advice of an estate administration attorney will help you with this decision.

5. Forgetting to advertise the estate. The law requires that the naming of the executor and the creation of the estate be advertised once a week for three weeks in a paper of general circulation and in the legal newspaper of the county of the decedent’s death. When working with a law firm like ours, this will be handled by the attorney. This is so that if debts were owed, creditors can come forward and make their claim on the estate. In Pennsylvania, there is a 4 to 6 year statute of limitations, meaning 3 years after the estate administration is done, a creditor could have a valid claim, but had you advertised, the creditor could have known beforehand. Additionally, advertising the estate cuts off claims after one year.

6. Getting help too late. Probate and estate administration can be a complicated process and is not as simple a job as it seems. Those who have been executors know that it can be very time consuming and difficult. Getting both legal and accounting help can make the job less time consuming, less difficult, and less emotionally draining as well as limiting your liability exposure. Let someone who has been through the process many times before help you through it. If a loved one just died and you need help with estate administration, our office can help.

7. Not meeting tax deadlines. Within 9 months you must file a PA inheritance tax return. In some cases, you must also file a Federal estate tax return. They must be filed timely, or you will get in trouble! Generally, these returns look simple, but there are many strategic issues and you have to make certain elections that can create a bit of confusion. Equally important in when you file them is how you file them. You want your returns prepared and filed professionally because professionals really know what they’re doing. They can help save you because they know the red flags, the things to avoid, the documents to attach.

8. Failing to conclude the estate. Once executors get to the end of an estate, oftentimes they just distribute the money without ever formally closing the estate. Before distributing assets, you can go to a court and get the okay from a judge, or if you want to skip that piece of the probate process and your family is all in agreement, you can form a family settlement. This gives everyone records of the estate administration so that they know where assets went and how much expenses were, so that the family can agree on these and not hold the executor liable for any mistakes. By documenting everything among family members, if later debt pops up, everybody agrees to give the money back and the executor has managed their liability. This must be prepared by an attorney and is a very powerful tool in protecting the executor’s liability.

These mistakes are common in the administration of an estate, so the best advice we can give you is to seek legal counsel to help you through the process.

|

|

|

|